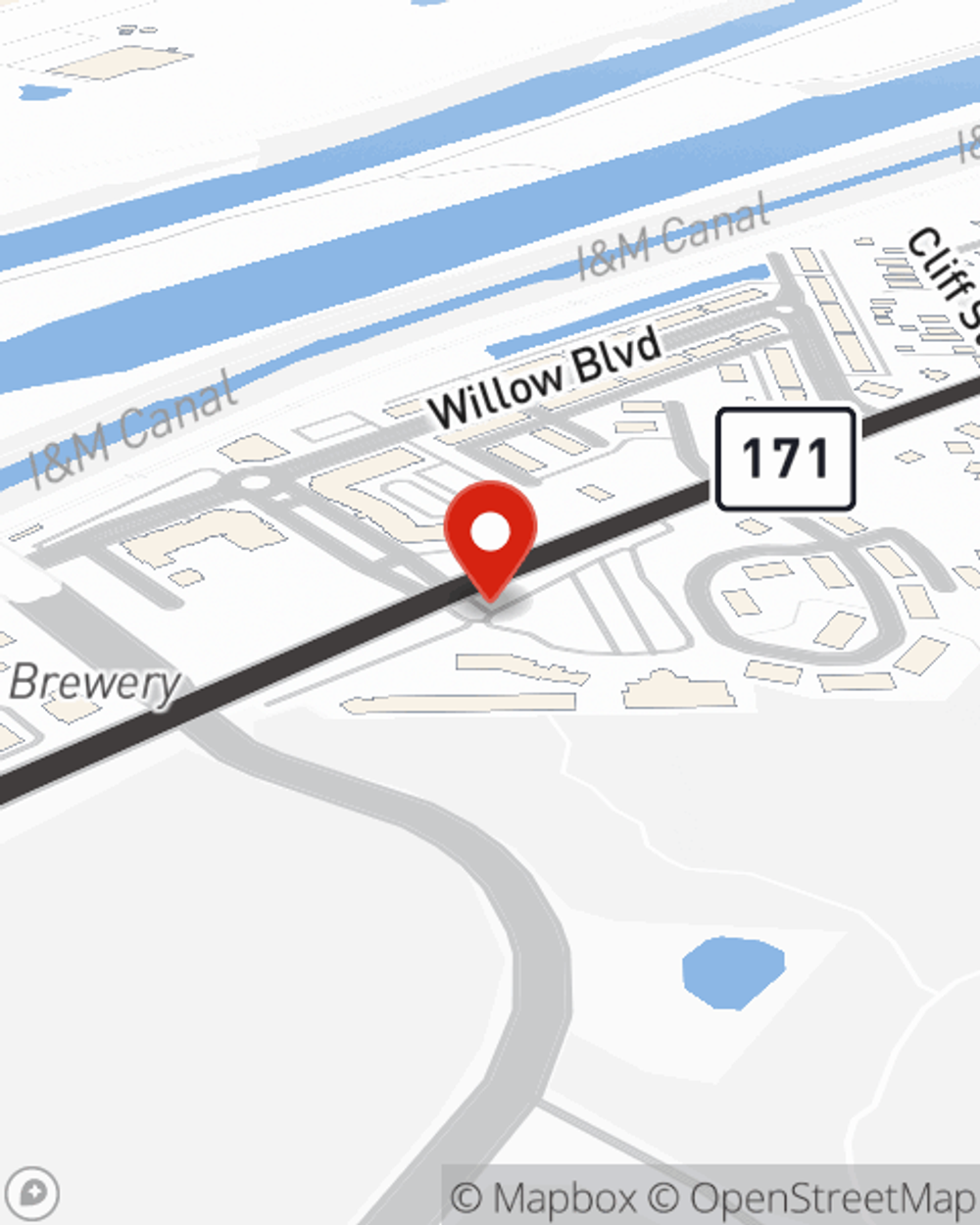

Life Insurance in and around Willow Springs

Get insured for what matters to you

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Willow Springs, IL

- LaGrange, IL

- Burr Ridge, IL

- Riverside, IL

- Countryside, IL

- Justice, IL

- Berwyn, IL

- Worth, IL

- Palos Hills, IL

- Palos Heights, IL

- LaGrange Park, IL

- Clarendon Hills, IL

- Hinsdale, IL

- Willowbrook, IL

- Oak Park, IL

- River Forest, IL

- Chicago, IL

- Lemont, IL

- North Riverside, IL

- Brookfield, IL

- Oak Brook, IL

- Downers Grove, IL

- Indiana

- Wisconsin

Check Out Life Insurance Options With State Farm

It may make you weary to fixate on when you pass, but preparing for that day with life insurance is one of the most significant ways you can show care to the ones you hold dear.

Get insured for what matters to you

Don't delay your search for Life insurance

Put Those Worries To Rest

Having the right life insurance coverage can help loss be a bit less overwhelming for those closest to you and provide space to grieve. It can also help cover current and future needs like utility bills, future savings and home repair costs.

When you and your family are insured by State Farm, you might rest easy knowing that even if something bad does happen, your loved ones may be protected. Call or go online now and discover how State Farm agent Jack Buoscio can help meet your life insurance needs.

Have More Questions About Life Insurance?

Call Jack at (708) 671-1111 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Jack Buoscio

State Farm® Insurance AgentSimple Insights®

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.